3.3 Development of a credit risk assessment model

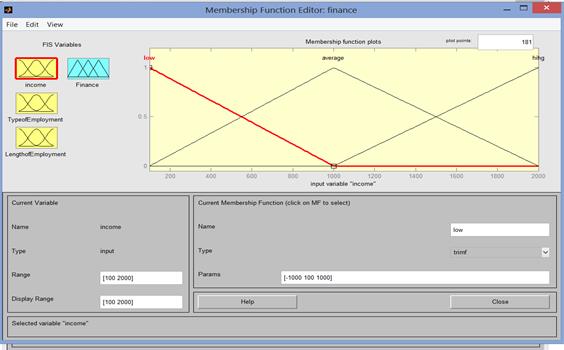

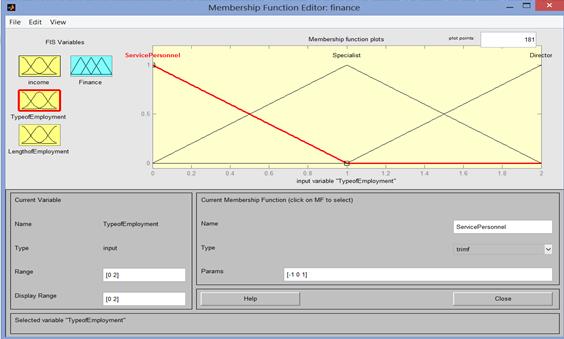

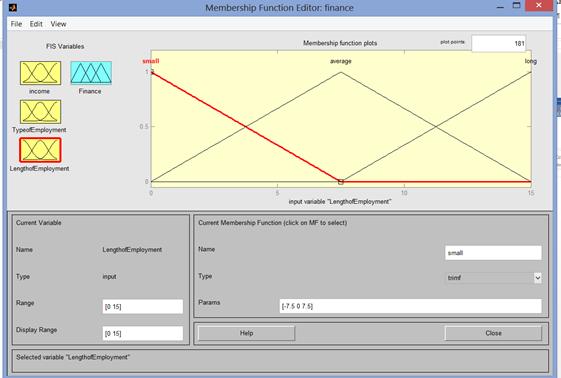

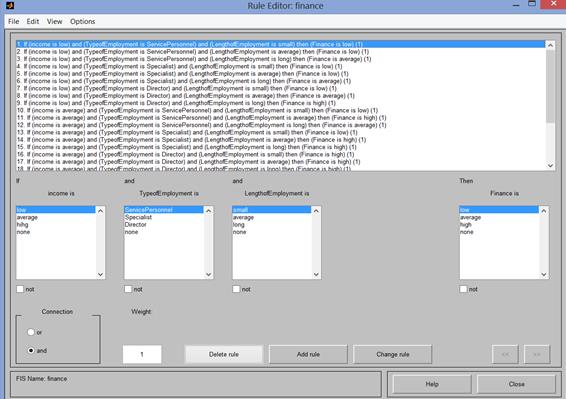

Matlab / Fuzzy logic is used to develop a borrower risk assessment model. The scheme uses three blocks of fuzzy logic with rule bases to determine the variables of the financial condition of the borrower, the demographic position of the borrower and the credit rating. As input data, we used the values of salary, job status, length of service to send a signal to the input of the fuzzy logic controller (fuzzy logic controller Finance).

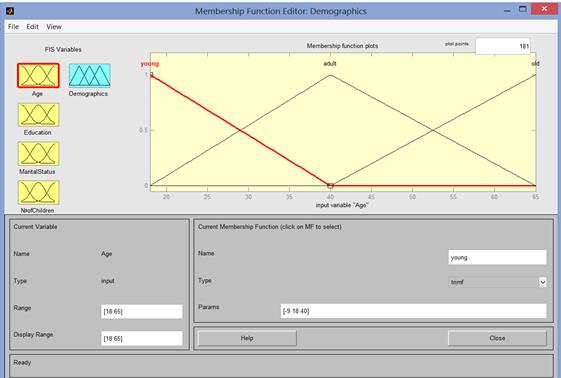

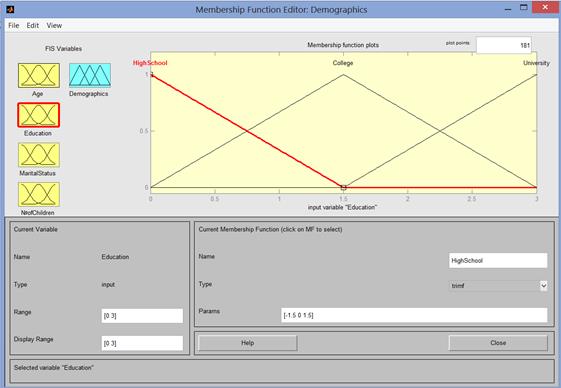

As input data, the values used are age, education, marital status, number of children for applying a signal to the input of the fuzzy logic controller Demographics. At the input of the third block of fuzzy logic (fuzzy logic controller Credit Rating) the data are submitted: the credit history of the borrower, the financial condition of the borrower, the demographic position of the borrower and information about whether there is a lack of real estate ownership.

3.3.1 Financial condition of the borrower (Finance)

To determine the variable financial condition of the borrower (Finance), a model based on the Mamdani withdrawal method is used.

When compiling the rule bases, the main relationships between the parameters were taken into account. According to the data obtained, an increase in income is considered to be a favorable factor for the financial condition of the borrower, since it reflects the best ability to repay the loan. An increase in the duration of employment is also a favorable factor, since an increase in the length of service of the borrower may be due to financial stability. Fuzzy inference is visualized using the Rule Viewer GUI module. This module allows you to illustrate the course of logical inference for each rule, obtaining the resulting fuzzy set and performing the defuzzification procedure. The Rule Viewer view for the tipper inference system with the functional purpose of the main fields of the graphic window [65, 66].

3.3.2 Demographics of the borrower

To determine the variable, the demographic position of the borrower took into account four variables: age, education, marital status, number of children. When compiling the rule bases, the main relationships between the parameters were taken into account.

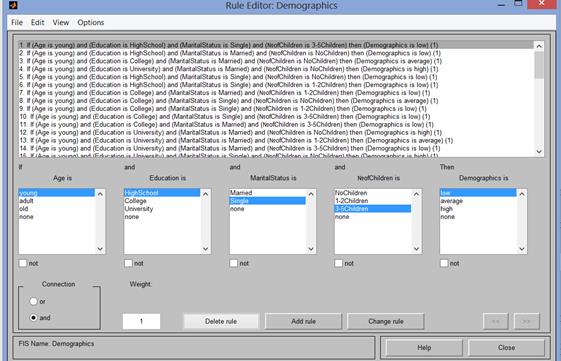

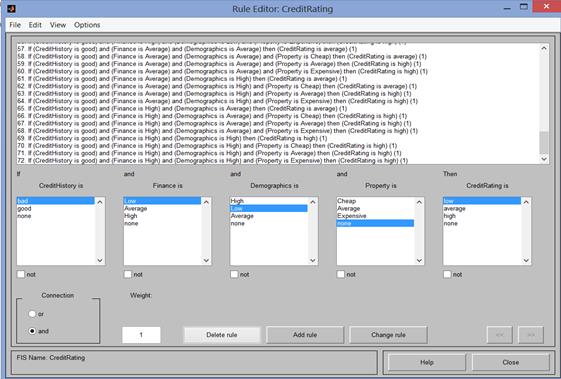

3.3.3 Credit rating of the borrower

To determine the final value of the borrower's credit rating, 4 variables were taken into account: the borrower's credit history, the borrower's financial condition, the demographic position of the borrower, and the presence or absence of real estate ownership. When compiling the rule bases, the main relationships between the parameters were taken into account.

Figure 3.5 – Accepted Range

Figure 3.6 – Accepted Range

Figure 3.7 – Accepted Range

Figure 3.8 – The rule base for determining financial condition

Figure 3.9 – Accepted Range

Figure 3.10 – Accepted Range

Figure 3.11 – The base of rules for determining the demographic position of the borrowere

Figure 3.12 – The Base rules for determining the credit rating of the borrower