3.2 Analysis of the state of electronic money development in the Republic of Kazakhstan

In the Republic of Kazakhstan, electronic money has received adequate legal support is relatively recent (2011-2012). In Kazakhstan, the procedure for issuing, using and redemption of electronic money, as well as requirements to electronic money issuers and electronic money systems are established by the National Bank of Kazakhstan.

The actual definition of electronic money does not contain a requirement to issue electronic money in an amount not exceeding the amount paid in advance. However, such a requirement is provided by the law, according to which the issue of electronic money is carried out by means of exchange for the amount of money equal to its nominal value.

The issuer of electronic money is a second-tier bank (commercial bank), which issues and repays electronic money in the electronic money system.

An important feature of electronic money functioning in Kazakhstan is that the owners of electronic money may be:

- individuals who have received electronic money from the issuer, agent or other individuals;

- agents;

- individual entrepreneurs or legal entities that have received electronic money from individuals as payment for civil law transactions.

Legal entities are not entitled to receive electronic money by any means other than as payment for goods delivered, works performed or services rendered. Therefore, legal entities as payers cannot use electronic money to make payments.

In case of receipt of electronic money by an individual entrepreneur or a legal entity from individuals when paying under civil law transactions, the issuer is obliged to redeem electronic money within three working days from the date of their receipt, unless otherwise stipulated by the contract. Repayment of electronic money is carried out by transfer of the amount of money equal to the nominal value of to the bank account of an individual entrepreneur or a legal entity.

Thus, electronic money payments can be made by exclusively owners-individuals for the purpose of making payments under civil law transactions and (or) other transactions related to the transfer of ownership of electronic money.

In the system of making payments with the use of electronic money in Kazakhstan also participates the operator of the system of electronic money a member of the system of electronic money, providing the functioning of the system of electronic money, including the implementation of the collection, processing and transfer of information formed during the transactions with the use of electronic money. In this case, the operator may be the issuer himself or another legal entity on the basis of the relevant contract concluded with the issuer.

The development of payment services is of key importance for ensuring the effective servicing of the country's financial system and the real sector of the economy.

The development of payment services and strengthening of the payment infrastructure is one of the areas of work aimed at enhancing the efficiency of the economy's functioning.

In recent years, the payment services market has undergone a number of changes, including innovative ones. Interest in the payment services market is conditioned by the need to maintain stability and efficiency of the financial system and to maintain confidence in the national currency. Innovations in the field of payment services have a positive effect on further development of the payment services market, which is becoming closer and closer for the payers through the emergence and use of convenient and simple payment instruments.

The electronic money market in Kazakhstan began to develop actively from the middle of 2013 and shows promising growth rates. For example, in 2014, 7.9 million transactions worth 21.0 billion tenge were made in Kazakhstan with the use of electronic money of Kazakhstani issuers. As compared to 2013, the number of transactions with the use of electronic money increased by 70 %. As of 1 January 2015, 18.7 billion tenge of electronic money was issued, and its indicator in circulation is 949.8 million tenge.

With the establishment in 2011 of a legal framework for the use of electronic money in the payment services market of Kazakhstan has received active development of the electronic money system. E-money became popular with the growth of the Internet audience and the spread of Internet commerce in Kazakhstan.

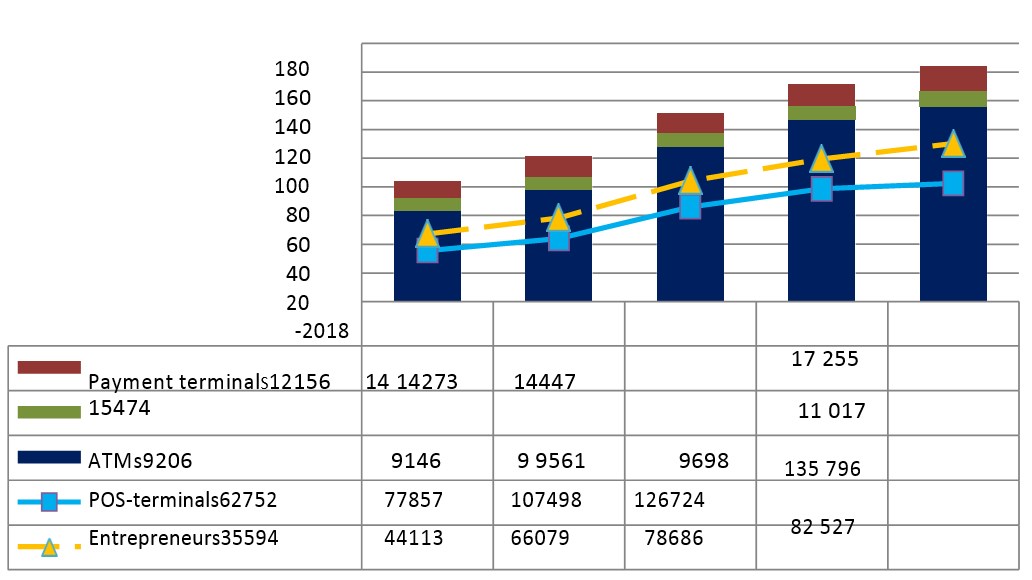

The development of remote banking in Kazakhstan is characterized by the expansion of the banking network by increasing the number of POS - terminals, respectively, the number of entrepreneurs and outlets that accept payment using payment cards, ATMs, payment terminals, improving the Internet channels of banks.

By the end of 2018, 135,796 POS-terminals, 11,017 ATMs, and 17,255 bank payment terminals were operating in Kazakhstan of terminals and 82,527 entrepreneurs in 110,153 outlets accepted payment using payment cards (Figure 1).

Compared to the end of 2017, the number of POS-terminals increased by 7,2 %, ATMs by 13,6 %, bank payment terminals by 11,5 %, entrepreneurs by 4,9 % and retail outlets by 10,7 %.

The ratio between the quantitative indicators of electronic banking terminals and the number of adults, 12 POS-terminals, 1 ATM, 2 payment terminals per 1,000 adults.

Figure 1 – Banking network

POS-terminals in Kazakhstan, as well as all over the world, can be divided into fixed and wireless/mobile terminals. At the same time, the ease of use of this equipment has increased significantly due to the entry to the Kazakhstani market of contactless technologies.

As of the end of 2018, the number of fixed POS-terminals was 70,026, and the number of mobile POS-terminals was 65,770. Every second terminal supports contactless payment function.

The main share of POS-terminals is used by entrepreneurs (93,5 % of all POS-terminals).

Table 5 – Distribution of POS-terminals by regions of Kazakhstan

|

Maximum value in the table |

Minimum value in the table |

|

Name of the region (city) |

Number of POS-terminals |

Changes from 2017 |

||||

|

In the banks. |

Entrepreneurs' business. |

In the banks. |

Entrepreneurs' business. |

|||

|

The hospital... noses |

Cell phones |

The hospital... noses |

Cell phones |

|||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

Akmola |

160 |

1 279 |

1 447 |

-62% |

+8% |

+30% |

|

Aktobe |

444 |

2 506 |

3 720 |

-15% |

+14% |

+65% |

|

Almaty |

666 |

1 272 |

1 118 |

-5% |

+4% |

-1% |

|

Atyrau |

321 |

1 870 |

2 116 |

-10% |

-12% |

+23% |

|

East Kazakhstani |

695 |

3 764 |

3 169 |

-18% |

+3% |

+9% |

|

Zhambyl |

414 |

1 093 |

897 |

-11% |

+5% |

+28% |

|

West Kazakhstani |

359 |

2 061 |

2 007 |

-13% |

+7% |

+16% |

|

Karaganda |

758 |

4 475 |

5 042 |

-24% |

+5% |

-1% |

|

Kostanai |

397 |

3 507 |

4 058 |

-29% |

+7% |

-31% |

|

Kyzylorda |

278 |

812 |

753 |

-28% |

+0,5% |

+43% |

|

Mangistau |

420 |

2 728 |

1 919 |

-2% |

48% |

+40% |

|

Pavlodar |

566 |

3 040 |

3 420 |

-9% |

+2% |

-9% |

|

North- Kazakhstani |

357 |

1 293 |

1 281 |

-18% |

-12% |

+5% |

|

Turkestan and Shymkent |

681 |

2 644 |

2 236 |

-4% |

-0,3% |

+33% |

|

Almaty |

1 088 |

17 957 |

19 029 |

-20% |

+10% |

+10% |

|

Astana |

1 213 |

10 908 |

13 558 |

+57% |

+11% |

+15% |

|

That's the total. |

8 817 |

61 209 |

65 770 |

-12% |

+8% |

+10% |

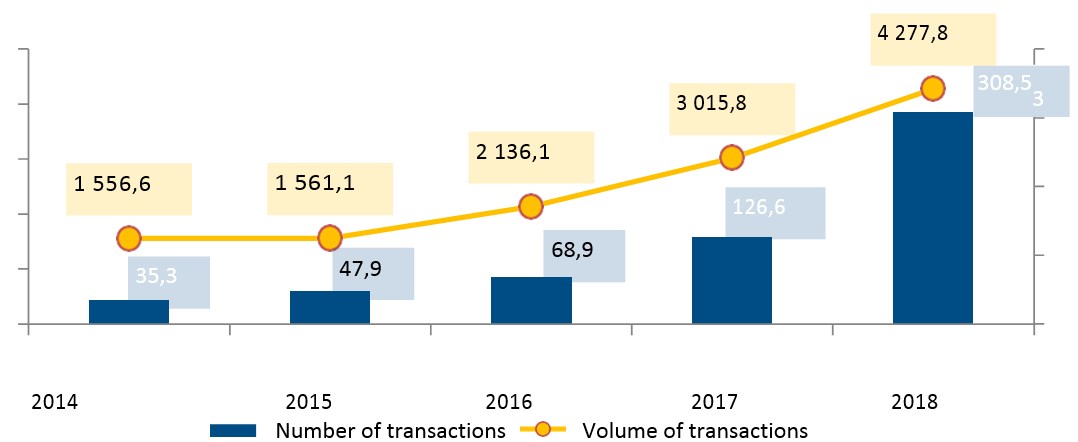

During 2018, 308.5 million transactions worth KZT 4.3 trillion were conducted through banks' POS terminals in Kazakhstan (figure 2), which is 2,4 times and 41,8 % more than in 2017, respectively.

Figure 2 – Increase in the number of transactions and the volume of numbers of transactions conducted via POS-terminals

291,7 million units of these transactions in the amount of KZT 2,3 trillion – non-cash payment (as compared to 2017, an increase of 2,6 times and 79,3 %, respectively).

Similar to 2017, in 2018 98 % of all non-cash transactions conducted through POS-terminals of banks – non-cash payment for goods and services.

At the same time, there has been an increase in the number and volume of money transfer transactions from one payment card to another: 4,1 million transactions in the amount of 170,7 billion tenge in 2018 compared to 1,9 million transactions in the amount of 95,1 billion tenge in 2017.

5,5 % (16,8 million transactions) of all operations carried out through POS-terminals – operations on withdrawal of money with payment card in cash desks of banks. At the same time, this number corresponds to about half of the total volume (KZT 1,9 trillion, 45,2 % of the total volume) conducted through this device during 2018.

Table 6 – Operations conducted through POS-terminals, by regions and cities of national importance in 2018

|

Name of the region (city) |

Type of operation |

Change from 2017 |

||||||

|

Cashless payments and money transfers |

Cash withdrawal operations |

Cashless payments and money transfers |

Cash withdrawal operations |

|||||

|

Quant ity, in million s. (c) «Tree» (d) |

Volume, in billion tenge |

Quant ity, in million s. (c) «Tree» (d) |

Volume, in billion tenge |

Quant ity, in million s. (c) «Tree» (d) |

Volume, in billion tenge |

Quant ity, in million s. (c) «Tree» (d) |

Volume, in billion tenge |

|

|

Akmola |

1,9 |

20,2 |

0,2 |

31,4 |

+135% |

+33% |

+25% |

+17% |

|

Aktobe |

6,3 |

59,7 |

0,4 |

70,5 |

+103% |

+54% |

+19% |

+17% |

|

Almaty |

1,7 |

22,2 |

0,2 |

51,3 |

+160% |

+13% |

+14% |

+20% |

|

Atyrau |

5,4 |

55,8 |

0,3 |

73,1 |

+84% |

+28% |

+8% |

+18% |

|

East Kazakhstani |

4,5 |

44,7 |

0,5 |

86,8 |

+118% |

+62% |

-0,4% |

+17% |

|

Zhambyl |

1,8 |

17,3 |

0,2 |

41,8 |

+201% |

+54% |

+64% |

+31% |

|

West Kazakhstani |

4,3 |

45,8 |

0,3 |

51,0 |

+126% |

+45% |

+7% |

+8% |

|

Karaganda |

12,9 |

103,6 |

0,5 |

99,4 |

+191% |

122% |

+0,2% |

+16% |

|

Kostanai |

10,6 |

40,8 |

0,3 |

59,5 |

+56% |

+59% |

+10% |

+2% |

|

Kyzylorda |

1,4 |

12,2 |

0,2 |

30,5 |

+188% |

+80% |

+55% |

+18% |

|

Mangistau |

5,0 |

44,7 |

0,2 |

80,2 |

+112% |

+69% |

+18% |

31% |

|

Pavlodar |

5,9 |

39,7 |

0,5 |

67,5 |

+135% |

+52% |

+8% |

+11% |

|

North- Kazakhstani |

2,3 |

15,5 |

0,2 |

26,8 |

+99% |

+59% |

+27% |

+6% |

|

Turkestan and Shymkent |

3,9 |

70,1 |

0,4 |

104,8 |

+142% |

6% |

+9% |

+6% |

|

Almaty |

177,3 |

1 426,9 |

11,9 |

881,2 |

+198% |

+106% |

+32% |

+17% |

|

Astana |

46,6 |

324,4 |

0,4 |

178,6 |

+108% |

+47% |

-13% |

-7% |

|

That's the total. |

291,7 |

2 343,6 |

16,8 |

1 934,2 |

+158% |

+79% |

+25% |

+13% |

With the creation in 2011 of the legal framework for the use of electronic money in the payment services market of Kazakhstan, the system of electronic money was actively developed. E-money became popular with the growth of the Internet audience and the spread of Internet commerce in Kazakhstan.

As of January 1, 2019, 18 e-money systems were in operation in the domestic market, the issuers of which were 10 banks and Kazpost JSC. They are: E-KZT, Wooppay, Visa Qiwi Wallet, Personal Cashier, Paypoint, Dar, Homepay, Halyk, AllPay, Wallet One, Kaspi Bank, MyBonus, Homebank Wallet, TengriWallet, Kazpost, RPS, Indigo24, Peytech.

In 2018, four new e-money systems were launched: Kazpost, whose issuer is Kazpost, as well as RPS, Indigo24 and Peytech, with the issuer AsiaCredit Bank. 3 e-money systems (Altynpay, MultiBank and AlemPay) and 3 issuing banks (Kazkommertsbank, Bank of Astana and Eximbank Kazakhstan) ceased to operate.

In 2018, the issuers of electronic money systems were issued electronic money in the amount of 521 billion tenge (a 57,1 % increase in the amount of issued electronic money compared to 2017).

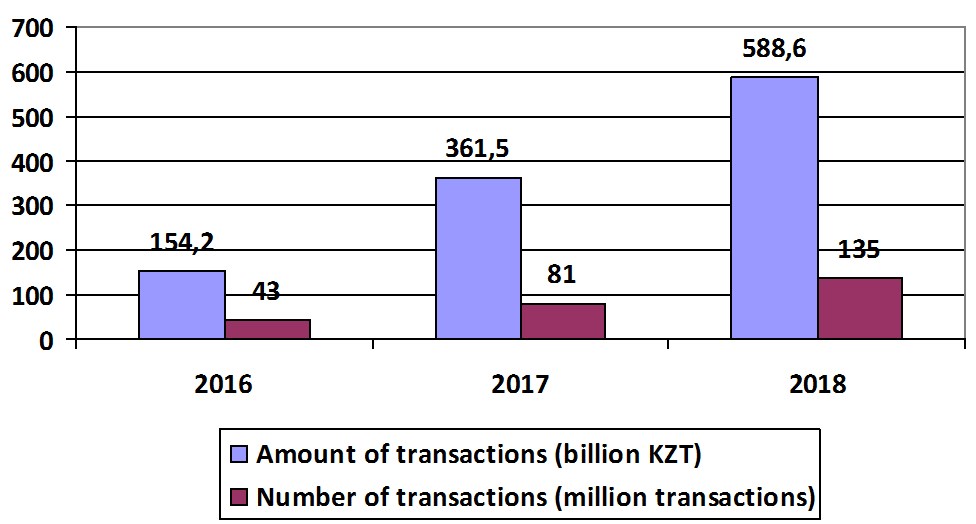

In terms of volumes of transactions performed, the growth in 2018 compared to 2017:

- the number of transactions by 65,8 %;

- transaction amounts by 62,8 %.

Figure 3 – Dynamics of electronic money usage

At the end of 2018, 135 million transactions worth KZT 588,6 billion were made with the use of electronic money issued by Kazakhstani issuers (an increase of 1.6 times in the amount of transactions and 1,7 times in the number of transactions completed) (figure 3).

These indicators include transfer transactions between individuals and payments for goods and services to legal entities and individual entrepreneurs:

- transfers to legal entities and individual entrepreneurs amounted to 119 million transactions in 2018 in the amount of KZT 495,3 billion.

The number of legal entities and individual entrepreneurs accepting electronic money – 8,480;

- transfers to individuals amounted to 16 million transactions in the amount of KZT 93.2 billion. At the same time, it should be noted that 90,2 % of the total volume of transactions with electronic money is accounted for by 4 e-money systems (e-money systems: «Kaspi Bank», «Qiwi Wallet», «Wooppay» and «Personal Cash Desk»).

These indicators include transfer transactions between individuals and payments for goods and services to legal entities and individual entrepreneurs:

- transfers to legal entities and individual entrepreneurs in 2018 amounted to 119 million transactions in the amount of 495,3 billion tenge;

- the number of legal entities and individual entrepreneurs who accept electronic money is 8,480;

- transfers to individuals amounted to 16 million transactions in the amount of KZT 93,2 billion.

It should be noted that 90,2 % of the total volume of transactions with electronic money falls on the share of 4 e-money systems (e-money systems: «Kaspi Bank», «Qiwi wallet», «Wooppay» and «Personal Cashier»).